Turning 65 brings a number of changes—and one of the most important is becoming eligible for Medicare. Whether you’re preparing to retire or continuing to work, understanding your Medicare options is essential to making confident, cost-effective healthcare decisions.

As an independent insurance agency, we specialize in helping individuals navigate Medicare’s complexities to find the coverage that fits their unique needs and budget. Here’s what you need to know before enrolling.

What Is Medicare?

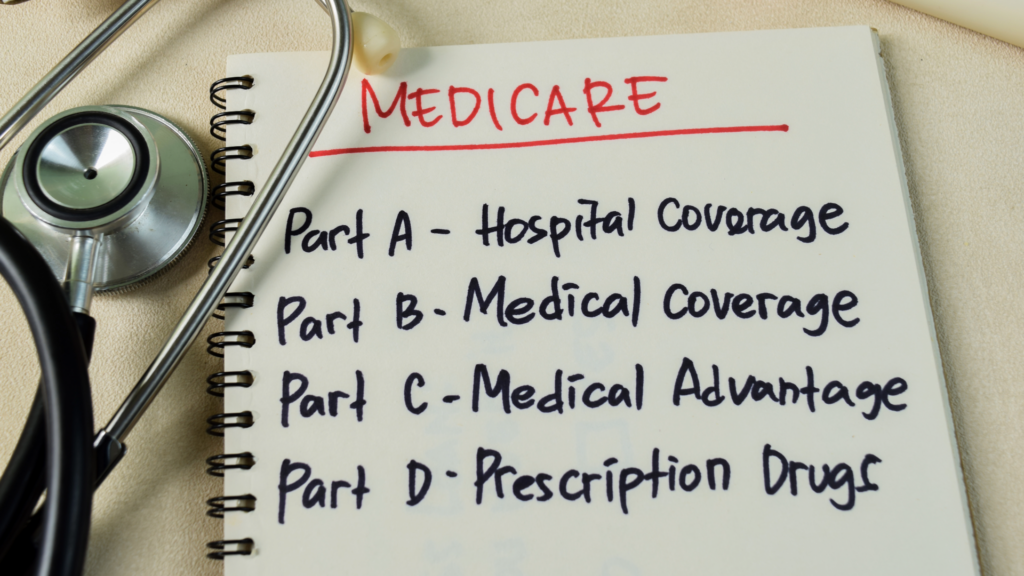

Medicare is the federal health insurance program primarily for people age 65 and older, as well as certain younger individuals with disabilities or specific conditions. It is divided into several parts, each covering different aspects of healthcare.

Understanding the Parts of Medicare

Part A – Hospital Insurance

Covers inpatient care in hospitals, skilled nursing facility care, hospice care, and some home health care. Most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes while working.

Part B – Medical Insurance

Covers outpatient services, doctor visits, preventive care, and medical equipment. Part B requires a monthly premium, which may vary based on your income.

Part C – Medicare Advantage Plans

These are private plans approved by Medicare that bundle Parts A and B and often include Part D (prescription drug coverage), along with additional benefits like vision, dental, and wellness programs.

Part D – Prescription Drug Coverage

Helps cover the cost of prescription medications. Plans vary by provider and can be added to Original Medicare or included in a Medicare Advantage plan.

When and How to Enroll in Medicare

Your Initial Enrollment Period (IEP) starts three months before the month you turn 65 and ends three months after. Enrolling on time is critical—delaying can result in late penalties and gaps in coverage.

If you’re already receiving Social Security benefits, you’ll typically be enrolled automatically in Parts A and B. If not, you can sign up through the Social Security Administration.

Medicare Supplement (Medigap) Plans

These are optional plans sold by private insurers to help cover the “gaps” in Original Medicare, such as copayments, coinsurance, and deductibles. They offer peace of mind for those who prefer predictable out-of-pocket costs.

Why Work with an Independent Insurance Agent for Medicare?

Navigating Medicare on your own can be overwhelming. An independent agent can:

- Compare multiple Medicare Advantage and Part D plans

- Help determine if Medigap is right for you

- Explain benefits and coverage clearly

- Ensure timely enrollment to avoid penalties

- Offer continued support as your needs change

Because we’re not tied to a single carrier, we focus solely on helping you find the best-fit coverage at the most competitive price.

Final Thoughts

Medicare is not one-size-fits-all. The right plan for your neighbor may not be the right one for you. By working with an experienced, independent insurance agency, you can feel confident in your healthcare coverage and focus on enjoying this next chapter of life.

Contact us today for a free Medicare consultation. We’ll walk you through your options and help you enroll in a plan that gives you peace of mind and long-term value.